Medicare Agent Huntington Ny Can Be Fun For Anyone

Wiki Article

The Definitive Guide to Medicare Agent Huntington Ny

Table of ContentsThe Best Strategy To Use For Medicare Agent Huntington NyGetting The Medicare Agent Huntington Ny To WorkHow Medicare Agent Huntington Ny can Save You Time, Stress, and Money.About Medicare Agent Huntington Ny

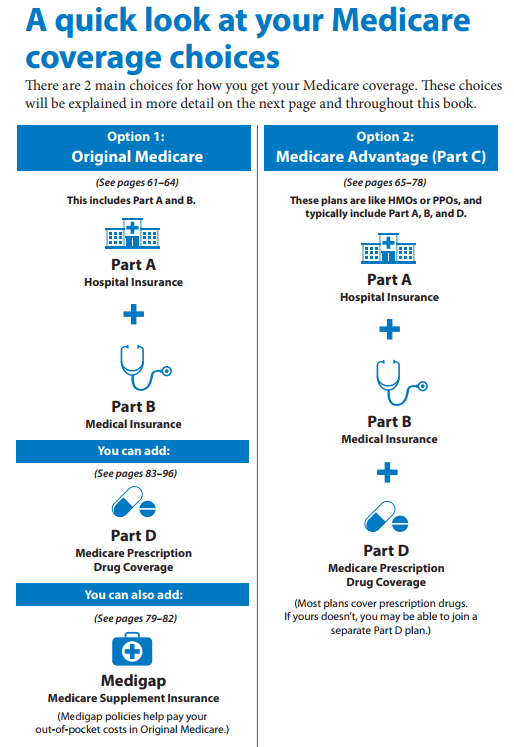

Navigating Medicare can be frustrating, also if you've bought your own health insurance policy in the past. You have several options to choose from, consisting of Original Medicare, Medicare Benefit and also Medicare Supplement Insurance. It takes some job to find out which kind of Medicare is right for you, along with which strategy covers every little thing you need.The net is an excellent place to start your study, but you might locate yourself seeking a person to talk to. That's where a Medicare agent or broker can assist. These are licensed professionals who can enlighten you concerning Medicare and help you register in a plan. At Quote, Wizard,.

A qualified Medicare agent, occasionally described as a broker, companions with health insurance companies to aid you sign up in a Medicare strategy. In order to get accredited, a Medicare agent should know the ins and outs of Medicare, be able to compare plans, clarify benefits and also identify qualification. Usually, there is no fee to collaborate with a Medicare broker.

There is never ever any type of obligation to sign up in a plan simply because an agent has aided you. Medicare representatives can give details about the Medicare prepares offered to you. You not only have multiple sorts of Medicare available to you, like Original Medicare, Medicare Advantage and Medicare Supplement, however you additionally have a huge selection of various strategies to pick from.

Some Known Facts About Medicare Agent Huntington Ny.

They'll ask concerning your: Health requires Budget plan Preferred physicians Medications With this details, they can offer you with plan options that inspect all the boxes. When you determine on a plan, a Medicare agent will then stroll you through the enrollment procedure and also make sure that your application gets sent to the health insurance firm for review.The goal is to make you really feel confident in your Medicare decision. At Quote, Wizard, we have a group of accredited and also knowledgeable Medicare agents offered to aid you.

They can break down the types of Medicare coverage and also clarify the pros and disadvantages of each. From there, they can stroll you with the plans offered in your location and also clarify the benefits in detail.: We collaborate with the top medical insurance companies in the country, whereas some Medicare brokers only work with one or two.

With more options to select from, you're most likely to locate a plan that's within your budget plan and fulfills your medical needs.: If you choose to enroll in a Medicare Supplement plan (likewise called Medigap) and you're not in your First Registration Period look what i found (IEP), you may be required to experience medical underwriting.

Getting My Medicare Agent Huntington Ny To Work

: When you've picked a plan, our Medicare agents will assist you finish the enrollment application. They will stroll you through each area as well as see to it that it's accurate and total. From there, it will be sent to the health and wellness insurance discover this info here policy company for review. If you would such as to function with a Quote, Wizard agent, simply phone call (855) 906-0601.Quote, Wizard. com LLC has striven to make certain that the information on this site is proper, yet we can not assure that it is without inaccuracies, errors, or noninclusions. All web content and also services supplied on or via this site are given "as is" as well as "as available" for use. Medicare agent Huntington NY.

com LLC makes no representations or guarantees of any kind of kind, reveal or suggested, as to the operation of this site or to the details, content, products, or products included on this site. You expressly agree that your use this site is at your single threat.

Certified representatives (likewise called brokers) as well as companies can aid Medicare recipients choose the ideal insurance coverage. Representatives are people who are licensed and also registered to solicit as well as enlist people right into insurance coverage products. Medicare agent Huntington NY. Agencies provide management support such as advertising and marketing, modern technology facilities, compliance, and also various other solutions for representatives. Medicare plans contract with agents and also agencies to reach as well as enroll recipients; in return, agents make compensations directly from insurance providers.

Getting My Medicare Agent Huntington Ny To Work

For standalone Component D strategies, the 2022 maximum national commission for new registration is $87 and also does not differ by area - Medicare agent Huntington NY. These payments are paid discover this info here when the beneficiary first signs up in an MA or Part D plan. As soon as a recipient is registered in an MA or Component D plan, representatives make a payment when the recipient switches to a new strategy or remains with the initial strategy.

CMS maximum compensation rates are established lower for "switchers" and "renewals" 50 percent of the first-time commission. For Part D, the national optimum revival payment is $44.

Report this wiki page